Sustainability vs. CSR vs. ESG Reporting: Breaking Down the Differences for Smarter Business Decisions

In the evolving business world, terms like Sustainability, Corporate Social Responsibility (CSR), and Environmental, Social, and Governance (ESG) Reporting often dominate discussions about corporate ethics and responsibility. While they share overlapping themes, each has a unique focus and purpose. Understanding their differences can help businesses make smarter decisions and create impactful strategies that resonate with stakeholders.

What is Sustainability in Business? A Long-Term Vision

Sustainability focuses on creating long-term value by aligning business practices with environmental preservation, social equity, and economic stability. It integrates deeply into a company’s operations, ensuring that present actions do not compromise the needs of future generations. Unlike CSR or ESG, sustainability influences the very foundation of how a business operates. Companies practicing sustainability often adopt eco-friendly measures such as renewable energy, circular economy principles, and resource conservation.

Example: A manufacturing company reduces its reliance on fossil fuels by switching to solar-powered facilities.The goal is to future-proof the business while contributing to global challenges like climate change and resource depletion.

Why It Matters: Sustainability enhances brand loyalty and operational efficiency while preparing businesses for future challenges like resource scarcity and regulatory changes.

Corporate Social Responsibility (CSR): A Voluntary Commitment

CSR is a company’s self-regulated commitment to contribute positively to society and the environment. It is often viewed as a way for companies to give back to the community beyond their business operations. CSR initiatives often include philanthropy, community projects, or ethical sourcing, focusing on external contributions rather than transforming internal processes.

Example : A retail brand funding educational programs in underprivileged communities or reducing plastic packaging to minimize environmental impact.

Why It Matters: CSR strengthens brand reputation and demonstrates that a company is committed to giving back, but it does not always address core business sustainability.

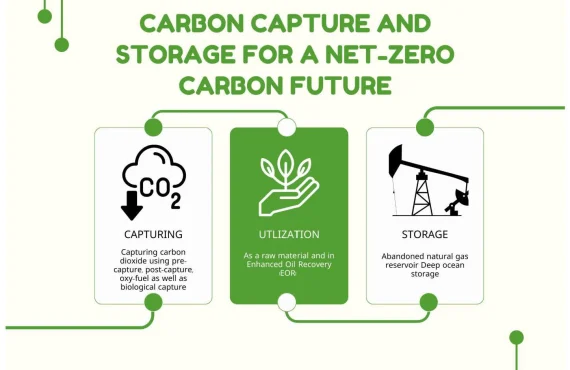

ESG Reporting: The Data-Driven Perspective

ESG Reporting goes beyond CSR’s qualitative focus by quantifying a company’s ethical and environmental performance. It provides measurable insights into areas like carbon emissions, diversity metrics, and board governance. ESG reporting is increasingly mandated by regulators and prioritized by investors, making it a critical tool for transparency and decision-making. Unlike CSR, which centers on goodwill, ESG links directly to financial and operational strategies, showcasing a company’s resilience and compliance with market demands.

Example: A company disclosing its annual carbon footprint, employee diversity ratios, and governance practices in a detailed ESG report.

Why It Matters: ESG reporting increasingly becomes a regulatory requirement, it serves as a vital tool for attracting investment, managing risks, and showcasing a company’s commitment to ethical practices.

Conclusion: Three Sides of the Same Coin

While these concepts overlap in their focus on responsibility, their distinctions are clear. Sustainability aims for holistic, long-term integration into a business’s core operations. CSR emphasizes external, voluntary efforts to engage with communities and enhance goodwill. ESG reporting, meanwhile, delivers quantifiable metrics to satisfy investor and regulatory expectations. Together, they form a comprehensive framework that addresses societal, environmental, and governance challenges from different angles.

By leveraging sustainability, CSR, and ESG reporting, businesses can meet stakeholder expectations, align with regulatory requirements, and drive long-term success. Companies that integrate these frameworks effectively are better positioned to navigate future challenges, build trust, and achieve sustained growth.