ESG integration: How ESG Can Transform Your Risk Management Strategy.

The Growing Threat of Climate Risk: ESG integration

In a world increasingly affected by climate change, businesses face growing risks from environmental disruptions, social upheavals, and governance failures. These risks are not only significant but also intensifying, forcing businesses to re-evaluate their strategies and adapt. ESG integration Climate change has moved beyond being a distant concern to becoming a pressing and immediate challenge that impacts every aspect of the global economy. ESG integration it helps companies address climate risks, comply with regulations, meet consumer demands for sustainability, and improve financial performance by focusing on long-term sustainability and transparency.

What is Climate Risk?

Climate risk refers to the potential negative impacts of climate change on businesses and economies. These impacts can be categorized into two primary areas:

- Physical Risks: These are tangible and include events such as extreme weather conditions, floods, hurricanes, rising sea levels, and prolonged droughts. Physical risks can directly disrupt operations, damage infrastructure, and lead to significant financial losses and also effect mental health.

- Transition Risks: These arise from the global shift toward a low-carbon economy. As governments impose stricter regulations, consumer preferences evolve, and technologies advance, businesses must adapt or risk falling behind. Companies that fail to transition may face higher costs, reduced market share, and diminished investor confidence.

Both types of risks demand urgent attention. Neglecting them could lead to financial instability, reputational damage, and a loss of competitive edge.

Why ESG Integration is Essential: ESG integration

Integrating Environmental, Social, and Governance (ESG) factors into risk management is no longer optional; it is a strategic necessity. Governments worldwide are enacting stricter environmental regulations, making compliance a critical component of doing business. Consumers increasingly prioritize brands that align with their values, and investors are focusing on ESG performance as a key criterion for allocating capital.

Beyond external pressures, businesses themselves stand to benefit from ESG integration. Proactively addressing climate risks through ESG frameworks can lead to greater resilience, improved financial performance, and enhanced stakeholder trust. Companies that incorporate ESG into their core strategies are better equipped to navigate uncertainties and capitalize on emerging opportunities.

Steps to Integrate ESG into Risk Management: ESG integration

Integrating ESG into risk management requires a thoughtful and comprehensive approach. Here are key steps businesses can take: ESG integration

Conducting a Climate Risk Assessment

The first step is understanding the specific risks your business faces. Conducting a thorough climate risk assessment involves identifying vulnerabilities, quantifying potential impacts, and prioritizing areas for action. This process helps organizations create a clear roadmap for mitigating risks and enhancing resilience.

Aligning with Global Standards

Adopting recognized frameworks like the Task Force on Climate-Related Financial Disclosures (TCFD), Business Responsibility Sustainability Reporting (BRSR), Global Reporting Initiative (GRI) or the United Nations Sustainable Development Goals (SDGs) ensures consistency and transparency. These frameworks provide guidelines for reporting, enabling businesses to communicate their progress effectively to stakeholders.

Scenario Planning and Preparedness

Scenario planning involves simulating various climate scenarios to anticipate potential disruptions. By understanding how different events might impact operations, companies can develop contingency plans and strengthen their ability to respond effectively.

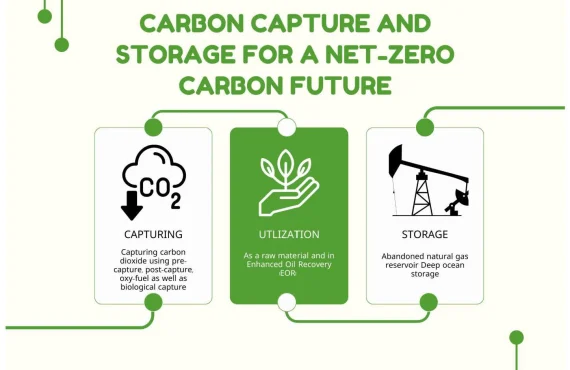

Investing in Sustainable Technologies

Technology plays a crucial role in ESG integration. From renewable energy systems to energy-efficient processes and carbon capture solutions, sustainable technologies help reduce environmental footprints while driving innovation and efficiency.

Fostering a Culture of Sustainability

ESG integration must extend beyond policies and frameworks to become a core part of the organizational culture. This involves educating employees, engaging stakeholders, and incorporating ESG goals into performance metrics. When sustainability becomes a shared value, businesses can achieve lasting impact.

The Benefits of ESG Integration

The advantages of integrating ESG into risk management are both immediate and long-term. Businesses that prioritize ESG gain resilience, enabling them to adapt and recover from climate-related disruptions. They also enhance their competitive position by aligning with consumer expectations and emerging market trends.

Financially, companies with strong ESG practices tend to outperform their peers. Reduced risks, operational efficiencies, and greater access to investment opportunities drive improved profitability. Additionally, robust ESG strategies attract institutional investors who value transparency, accountability, and long-term vision.

Real-World Examples of ESG Success

Several companies have demonstrated the transformative power of ESG integration:

- Unilever: Through its “Sustainable Living Plan,” Unilever has aligned its business operations with sustainability goals, enhancing resilience and profitability.

- Microsoft: Committed to becoming carbon-negative by 2030, Microsoft has invested heavily in renewable energy and innovative technologies, setting a benchmark for corporate responsibility.

- Patagonia: Known for its ethical practices and environmental stewardship, Patagonia has built a loyal customer base while inspiring industry peers to prioritize sustainability.

Consequences of Inaction

Ignoring climate risks can have severe consequences. Businesses that fail to prepare may face escalating operational costs, supply chain disruptions, and regulatory penalties. Reputational damage can erode consumer trust and diminish brand value, while missed opportunities for innovation and market leadership leave companies vulnerable to competitors.

The Role of Stakeholders

Stakeholders—including consumers, investors, and employees—play a crucial role in driving ESG adoption. Consumers can support sustainable brands and demand greater transparency. Investors can allocate funds to companies with robust ESG strategies and advocate for stricter climate-related regulations. Employees, too, can champion sustainability initiatives, fostering a culture of accountability and innovation.

To know about top ESG courses click here: